Fund Accounting Mistakes That Trigger Audits and Lose Trust

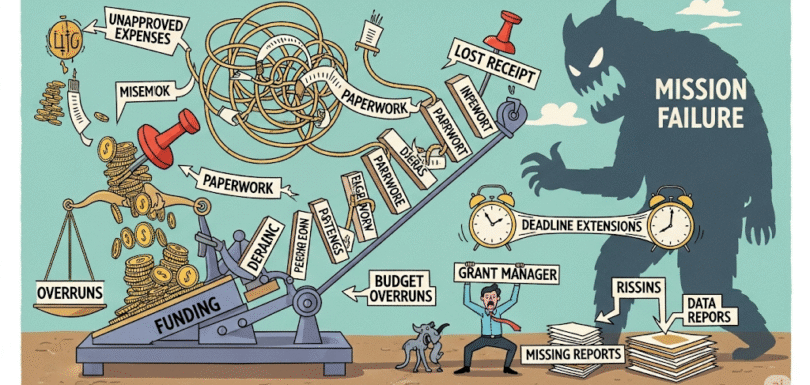

Unlike a for-profit, your nonprofit’s accounting isn’t just about profit and loss—it’s about fund stewardship. Get it wrong and you risk audits, audit-triggered grant holds, and lost donor trust. Fund Accounting Pitfalls Fixing Fund Accounting Fast 1. Segregate Everything Unique codes and bank accounts for each fund/grant. 2. Document, Document, Document Every transfer, […]