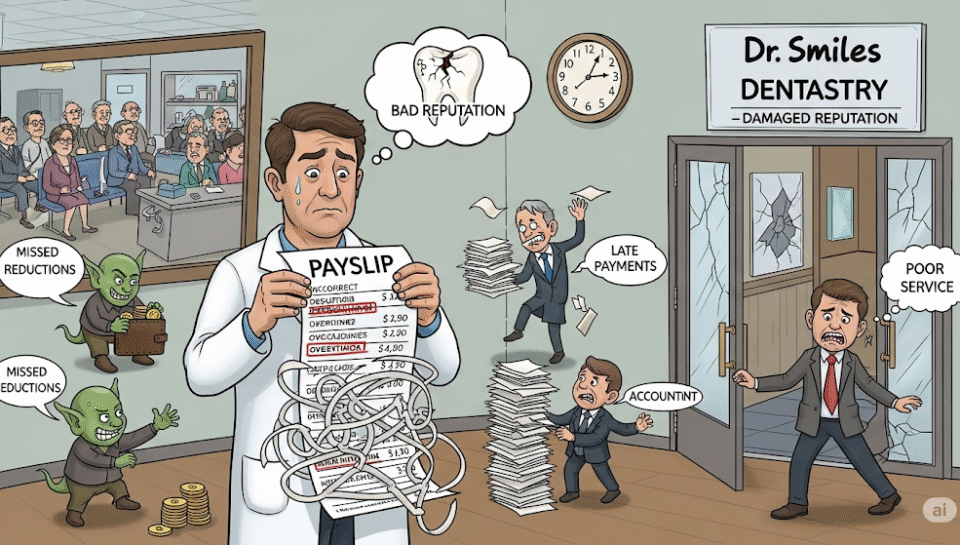

Imagine your hygienist or assistant opening their paycheck—only to spot a missing bonus or overtime error. Payroll mistakes don’t just cost money—they can cost your reputation and patient satisfaction.

Payroll Mistakes to Watch For

- Paying the wrong hourly rate or missing shift differentials

- Misclassifying employees as contractors (hello, IRS issues)

- Delayed payroll runs—staff waiting, tensions rising

Why Payroll Accuracy Matters

Unhappy staff lead to high turnover, service hiccups, and—eventually—unhappy patients. And let’s not forget about late tax deposits and government fines!

How to Prevent Payroll Drama

1. Use Software

Ditch manual calculations and spreadsheets. Payroll tools catch errors before paychecks go out.

2. Stay Compliant

Understand state and federal wage laws for healthcare and dental practices.

3. Review Regularly

Double-check pay rates, bonuses, and tax withholdings every cycle.

4. Outsource if Needed

Dental payroll experts (like SkillBench!) ensure smooth, accurate paydays.

Final Word

Happy teams mean happy patients. Nail payroll and you’ll keep both!