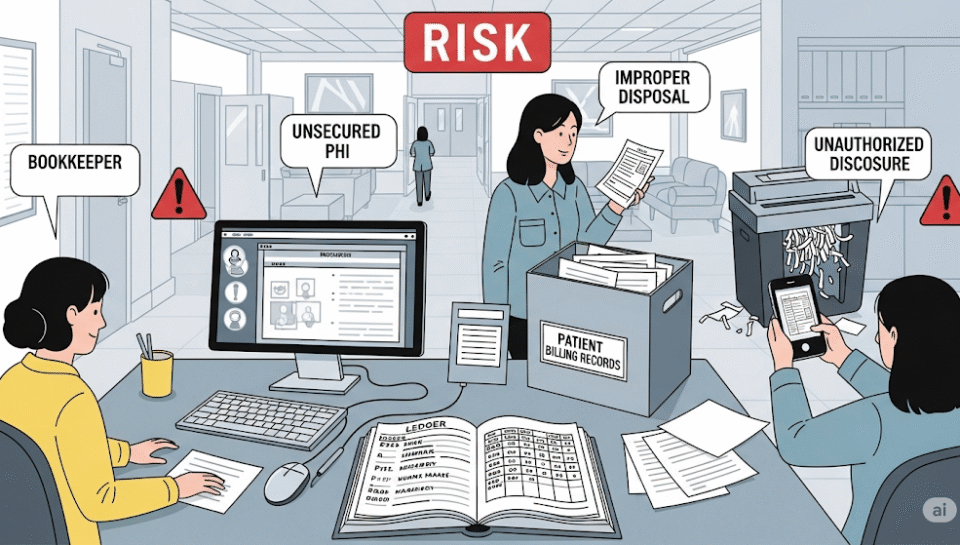

Dental practices handle personal health info every day—but it’s easy to overlook HIPAA risks lurking in bookkeeping.

Common HIPAA Bookkeeping Risks

- Storing patient billing info in shared folders or unlocked cabinets

- Emailing spreadsheets without encryption

- Failing to properly shred/dispose of old records

- Accessing records from unsecure devices

How to Avoid a HIPAA Headache

1. Use Secure Systems

Bookkeeping and billing software should be encrypted and HIPAA-compliant.

2. Control Access

Limit who can view sensitive info; assign unique logins for every staff member.

3. Train, Train, Train

Make HIPAA a regular priority at staff meetings—not just once a year.

4. Work With HIPAA-Savvy Pros

Dental accountants who “get” HIPAA can help keep you in (safe) compliance.

The SkillBench Promise

We use strict protocols to secure your data, so your practice and reputation are protected. HIPAA headaches? Not with us on your team.