Running payroll in construction is like getting the right mix on a cement truck—a little imbalance, and suddenly everything’s messy. The good news? Payroll problems can be fixed with the right systems in place.

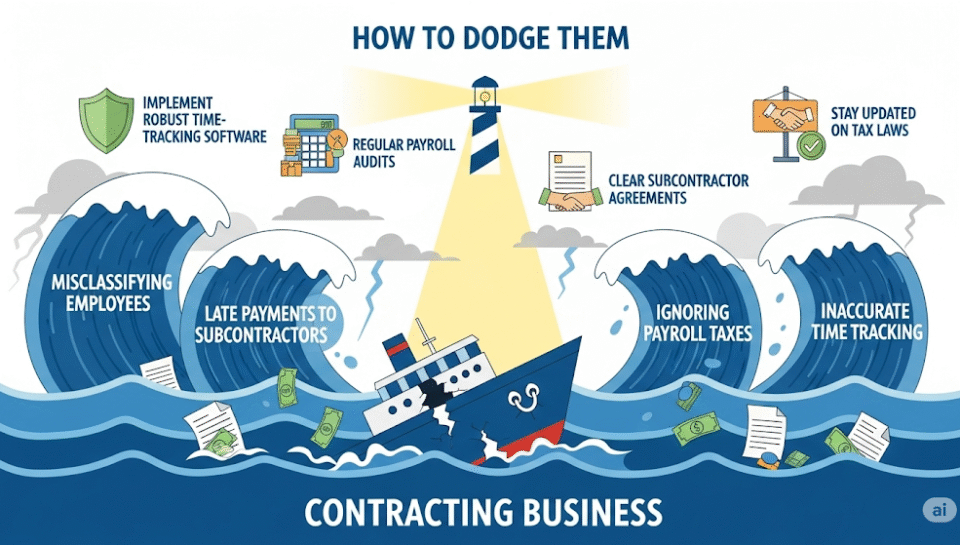

Top Construction Payroll Pitfalls

- Misclassifying Workers: The IRS and Labor Department don’t take kindly to “oops, I thought they were independent contractors.”

- Ignoring Local Compliance: Prevailing wage laws, union requirements, and multi-site ops complicate payroll beyond basic checks.

- Late or Missed Payments: Employees go unpaid if DOL compliance isn’t priority, leading to fines and conflicts.

How to Prevent Payroll Nightmares

1. Proper Classification

Check each worker’s status—W-2 or 1099? Get it right, and avoid fines or lawsuits.

2. Monitor Hours Diligently

Use time-tracking tools for accurate hours, OT, and compliance. Manually? You’re begging for math headaches.

3. Connect with Compliance Pros

Consult a CPA or compliance expert to understand state and federal codes. Fines eat into your profit faster than neglected materials!

4. Invest in Payroll Systems

Forget spreadsheets—invest in software designed for construction payroll, with built-in compliance tools.

Bottom Line

Contracting thrives on getting details right—from projects to payroll. Keep your construction crew happy, compliant, and paid. Need a hand? SkillBench provides expert contracting payroll solutions that fit your field.