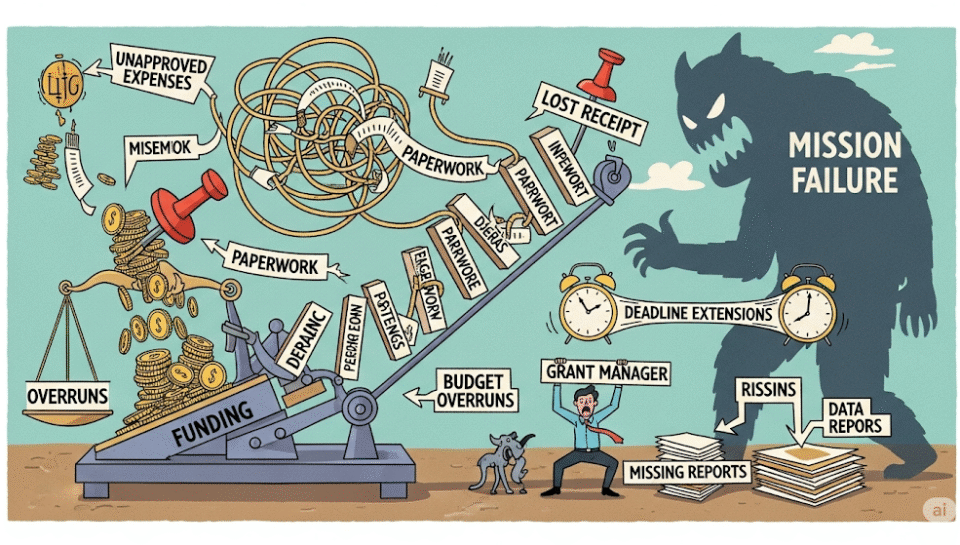

Grant applications aren’t easy to win—so why jeopardize hard-won funding with bad tracking? From missed deadlines to unclear spending, grant reporting is riddled with landmines. One mistake and you’re facing clawbacks, angry funders, or a reputation hit that endangers your mission.

Where Nonprofits Slip Up

- Mixing up restricted and unrestricted funds

- Missing grant deadlines or reporting requirements

- Failing to track expenditure by grant line item

- Lack of documentation for payroll and expenses

The Real Risks

- Grant funds put on hold or clawed back

- Lost credibility—kiss future grants goodbye

- Internal panic when auditors demand records you can’t find

How to Keep Grants (and Sanity) Secure

1. Use Grant-Specific Accounting Tools

Ditch generic spreadsheets—choose tools that tag and track every grant dollar.

2. Separate Funds

Open unique accounts/codes for each grant to avoid mixing money.

3. Monthly Reviews

Schedule time to review grant spending and documentation. Scrambling at report time is a recipe for mistakes.

4. Work With Pros

A nonprofit CPA spots compliance risks before they cause costly trouble.

Final Note

Great work deserves great tracking. SkillBench helps nonprofits build audit-proof, grant-winning systems—so your mission never stalls on avoidable errors.