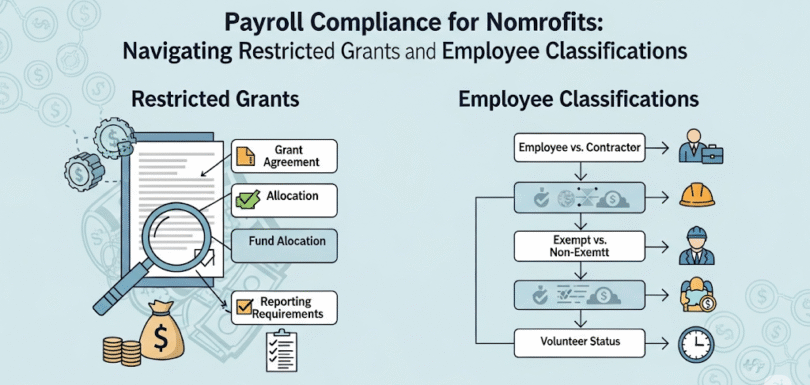

Payroll Compliance for Nonprofits: Navigating Restricted Grants and Employee Classifications

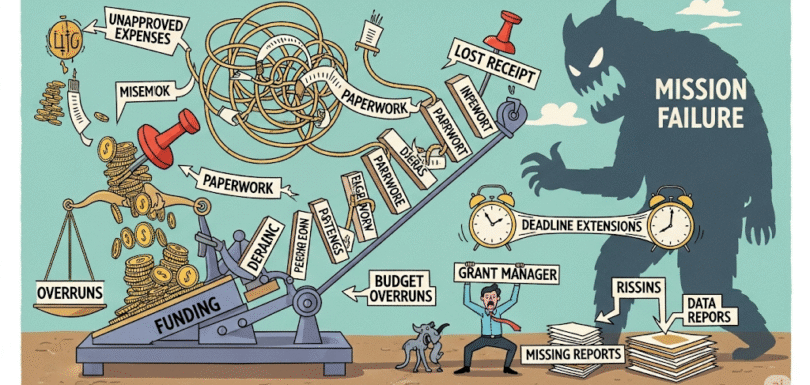

Payroll at a nonprofit isn’t just about getting checks out on time—it’s about matching expenses to grants, tracking staff across programs, and avoiding IRS & Department of Labor issues. Payroll Complications Nonprofits Face How to Stay Compliant 1. Use Job & Grant Codes Tie every payroll entry to specific grants and programs. 2. […]