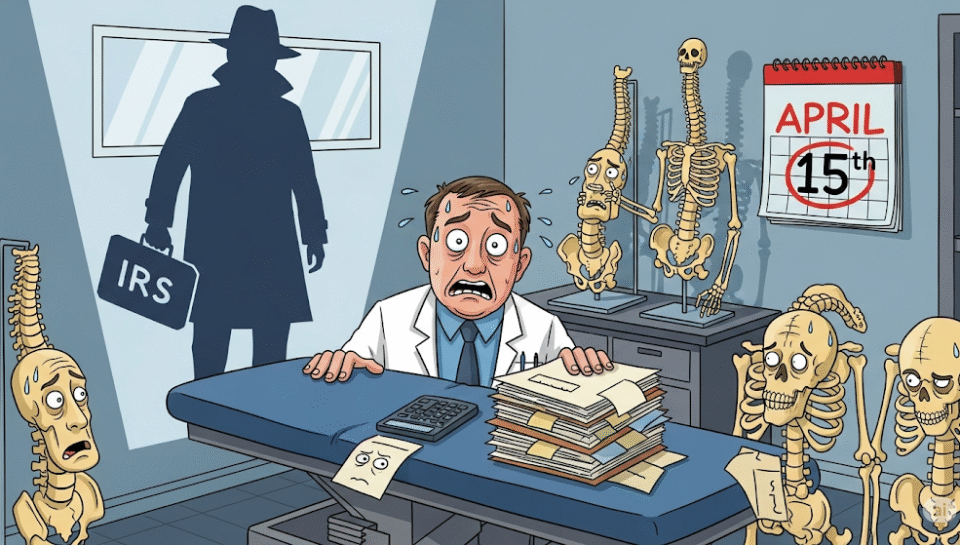

Let’s face it: words like “audit” send chills down any chiropractor’s spine—usually faster than a patient can say, “It hurts here.” But IRS audits often aren’t about big crimes—they’re about little mistakes, missing receipts, or inconsistent books.

Why Chiropractors Get Audited

- Frequent cash payments, which are easy to misreport.

- Deducting personal expenses as practice write-offs.

- Late or inconsistent tax filings.

- Staff classified incorrectly on payroll.

How to Audit-Proof Your Practice

1. Document Everything

Keep digital backup of every expense, payment, and deposit.

2. Separate Personal and Business

No more “office coffee shop” receipts mixing with family brunch.

3. Keep Payroll Squeaky Clean

Know the difference between W-2, 1099, and what local labor laws say.

4. CPA Review—Regularly

Hire a pro to review your books quarterly. Small issues won’t grow into big ones.

Final Adjustments

Don’t wait for the IRS to call—take charge of your financial health now. With SkillBench, you get audit-ready books and peace of mind, so you can keep caring for patients, not dodging paperwork.