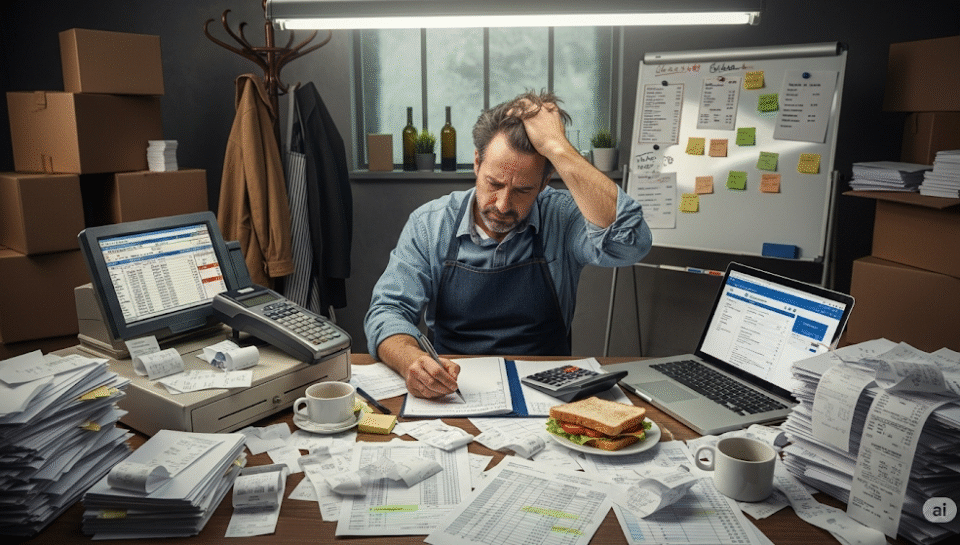

You know that glazed-over look when someone asks if your POS report actually matches your bank deposit? Too many restaurant owners know the pain: receipts don’t match deposits, tips are off, and there’s always some “mystery adjustment.” It adds up to long nights and worrisome tax seasons.

The Real Cost of POS Confusion

- Lost revenue from untracked cash or overlooked credit card fees

- Long, stressful closes and bank runs

- Increased audit risk and tax headaches

Common Causes

- Manual entry errors and skipped end-of-day closings

- Tips not properly reported

- Voids, refunds, or discounts never reconciled

- The Recipe for Reconciliation Zen

1. Daily Routines

Close your POS, tally cash, and check deposits every single night. No exceptions—even after busy shifts!

2. Smart Software

Use restaurant accounting tools that sync POS data with bookkeeping, flag inconsistencies, and help you resolve them.

3. Know Your Gaps

Track tips, voids, and comps separately; make a checklist for your staff.

4. CPA Touch

Monthly reviews by restaurant-savvy CPAs keep you on track and audit-ready.

Why It Matters

Clean books mean no surprises, faster closes, and peace of mind when tax season (or the IRS) rolls around. At SkillBench, we help restaurants ditch manual chaos and run like clockwork.