Payroll at a nonprofit isn’t just about getting checks out on time—it’s about matching expenses to grants, tracking staff across programs, and avoiding IRS & Department of Labor issues.

Payroll Complications Nonprofits Face

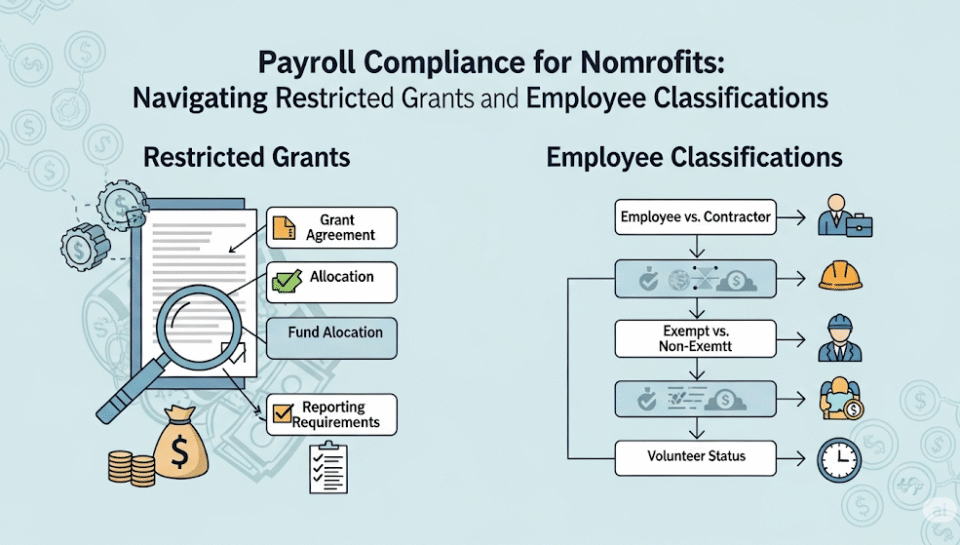

- Allocating salaries across multiple grants/programs

- Classifying part-time, full-time, consultant, and intern pay

- Handling restricted grant rules for compensation

- Tracking payroll tax compliance

How to Stay Compliant

1. Use Job & Grant Codes

Tie every payroll entry to specific grants and programs.

2. Understand Classifications

Review job descriptions with a CPA to get W-2/1099/volunteer right.

3. Automate Allocations

Software can split pay by project, saving hours of manual work.

4. Document Everything

Track time sheets, grant approvals, and all payroll backup.

Best Practice

A nonprofit payroll expert ensures accurate reporting and staff satisfaction. SkillBench knows the nonprofit payroll rules—so you can focus on changing the world.